The UK’s non-profit sector is facing a period of unprecedented strain. A relentless combination of rising costs, unpredictable income, and surging demand has created a “big squeeze” on organisations of every size. The National Council for Voluntary Organisations (NCVO) has aptly named this challenge the ‘Cost of Giving Crisis’—a reality where keeping the doors open has become the primary, all-consuming mission for many.2 If you’re a charity trustee, CEO, or finance manager, the pressure of navigating this landscape is immense. You’re not just dealing with spreadsheets; you’re safeguarding vital services that communities depend on.

This is not just another article reporting on the problem. This is an actionable survival toolkit. We will move beyond the headlines to provide a clear, strategic roadmap designed to guide your organisation from a state of crisis to one of sustainable resilience. We will break down the current financial pressures, show you how to strengthen your internal governance, provide a practical guide to diversifying your income, and offer tailored tactics specifically for small charities. It’s time to turn pressure into a plan.

- The Perfect Storm: Understanding the Financial Pressures on UK Charities in 2025

- Strengthening Your Core: Mastering Financial Governance and Reserves

- The Resilience Roadmap: A Practical Guide to Diversifying Charity Income

- A Toolkit for Small Charities: Overcoming Unique Financial Hurdles

- Conclusion

- Sources & Further Reading

The Perfect Storm: Understanding the Financial Pressures on UK Charities in 2025

To build resilience, we must first understand the forces at play. The current financial environment for the UK non-profit sector is a perfect storm of compounding challenges. It’s a landscape where 86% of charitable organisations worry about the impact of cost-of-living increases on their service users, even as their own resources are stretched thin. With inflation predicted to remain a significant factor, hovering around 3.7% into 2025, the pressure on already tight budgets is intensifying. This isn’t a temporary dip; it’s a new economic reality that demands a new strategic response.

Inflation’s Squeeze: How Rising Costs Are Eroding Budgets

Inflation is not an abstract economic term; it’s a direct and tangible drain on your charity’s resources. Every aspect of your operations, from energy bills and insurance premiums to supplies and venue hire, costs more than it did a year ago. This is acutely felt in staffing costs, a primary expense for most charities. While necessary increases to the National Living Wage are a welcome support for employees, they add significant pressure to payrolls.

The NCVO’s analysis highlights this squeeze perfectly: even when wages rise, their real-world value is diminished.2 A pay rise of 3.8% in a high-inflation environment can equate to a real-terms decrease in spending power, impacting staff morale and retention while simultaneously increasing the charity’s overheads. This relentless erosion of your budget means every pound raised has to work harder just to maintain the status quo, let alone fund growth or innovation.

The Double Bind: Surging Demand Meets Declining Income

The core of the “big squeeze” is a painful paradox: as the cost-of-living crisis drives more people to seek help, the very same crisis reduces the public’s ability to give. This creates a double bind of surging demand and declining income. The Charity Finance Group (CFG) captured this sentiment perfectly in a recent survey, with one small charity leader stating, “Costs have gone up…while we’re expected to deliver more”.3

The data paints a stark picture: 71% of charity leaders are concerned about managing this increased demand for their services, while 59% are worried about a corresponding drop in donations. This pressure is compounded by a reduction in government funding and a lack of targeted support in recent fiscal statements, leaving charities to bridge the gap themselves. For a deeper look at navigating these issues, the NCVO’s Guide to Financial Challenges offers valuable frameworks.

The Safety Net is Fraying: The Dangerous Depletion of Charity Reserves

Faced with operational shortfalls, many charities have been forced to turn to their last line of defence: their financial reserves. Recent data shows that one in four charities have had to draw on their reserves simply to manage day-to-day costs. While reserves are there to be used in difficult times, relying on them to cover routine deficits is unsustainable and a clear sign of financial distress.

This depletion of charity reserves poses a significant long-term risk to the sector’s stability. The Charity Commission views the responsible management of reserves as a cornerstone of good financial stewardship.1 A fraying safety net not only jeopardises a charity’s ability to weather future unexpected crises but also threatens its very existence, making the need for robust financial governance more critical than ever.

Strengthening Your Core: Mastering Financial Governance and Reserves

In a turbulent environment, a strong internal core is your most valuable asset. Proactive financial governance is not about restrictive bureaucracy; it’s about creating the stability and clarity needed to make confident strategic decisions. The foundation of this stability is a robust and well-considered reserves policy, a topic on which the Charity Commission Financial Guidance blog offers timely reminders.

The Charity Commission’s official guidance (CC19) makes it clear that managing reserves is a fundamental duty for trustees. It highlights the dual risks of getting it wrong: holding reserves that are too high can tie up funds that should be used for charitable activities, while reserves that are too low increase “the risks of unplanned and unmanaged closure and insolvency”.1 Mastering your reserves policy is the first and most critical step in moving from a reactive to a resilient footing.

Your Reserves Policy: A Step-by-Step Guide Based on CC19 Guidance

A reserves policy is more than a number; it’s a statement of your charity’s financial strategy. It explains to funders, beneficiaries, and regulators why you hold reserves, how much you aim to hold, and how you will use them. Reviewing this policy annually is a critical trustee responsibility.

Step 1: Calculating Your Target Reserve Level

There is no one-size-fits-all answer for a target reserve level. The Charity Commission’s CC19 guidance advises trustees to conduct a realistic assessment based on their specific circumstances.1 Consider factors such as:

- Income Reliability: How secure and predictable are your main income streams?

- Cost Structure: What are your fixed monthly costs (salaries, rent) that must be covered? A common starting point is to aim for 3-6 months of essential running costs.

- Future Plans: Are you planning any significant projects or capital expenditures?

- Risks & Opportunities: What potential financial shocks could you face (e.g., loss of a major grant)? What opportunities might require upfront investment?

Documenting the rationale behind your calculation is just as important as the final number.

Step 2: Writing a Clear and Justifiable Policy

Your written policy should be a clear, concise document. Based on CC19 requirements, it should include:

- The purpose of the policy.

- The target level of reserves (e.g., “between 3 and 6 months of unrestricted operational expenditure”) and the calculation used to arrive at it.

- The steps you will take if reserves fall below the target or significantly exceed it.

- The agreed-upon review schedule (typically annually).

For your annual report, consider using clear wording such as: “The trustees have established a reserves policy to ensure the continuity of our core services. Our target is to hold X months of operational costs, which amounts to approximately £Y. At the end of the financial year, our reserves stood at £Z, which is in line with our policy.”

Scenario Planning: What To Do If Reserves Are Depleting

If your monitoring shows that reserves are depleting rapidly and unsustainably, you must act decisively. This is where scenario planning becomes vital. The Charity Commission’s CC12 guidance on managing financial difficulties outlines the serious duties of trustees in this situation.4

Practical first steps, often recommended by financial advisors, include:

- Immediate Review: Convene a board meeting to review the latest financial forecasts and understand the rate of depletion.

- Re-forecast: Create best-case, worst-case, and realistic cash flow scenarios for the next 6-12 months.

- Identify Levers: Brainstorm all possible actions to reduce costs and increase income, no matter how difficult.

- Prioritise: Rank these actions by impact and feasibility.

- Action Plan: Create a clear plan with responsibilities and deadlines.

This is a challenging process, and resources like the Charity Finance Group Sustainability Hub can provide valuable frameworks and support.

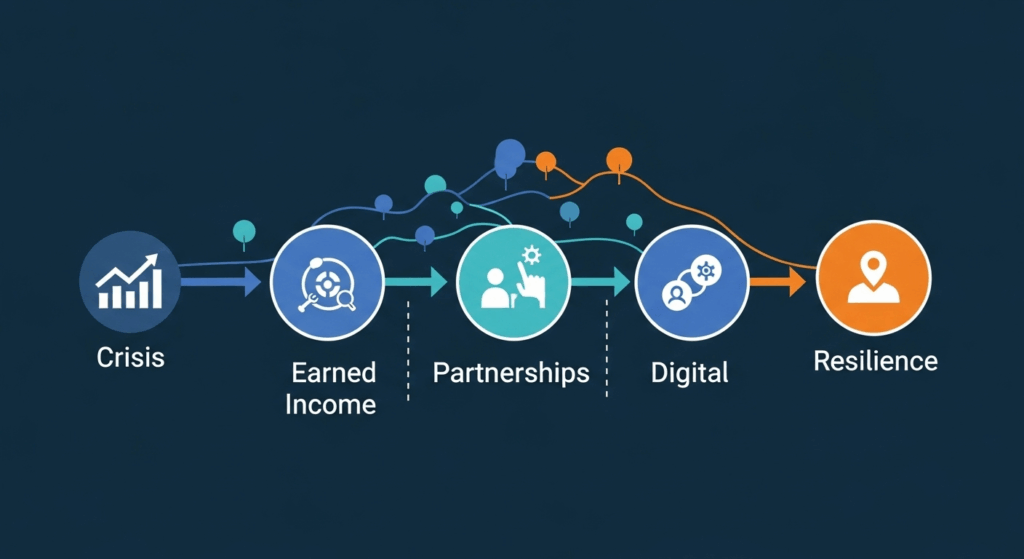

The Resilience Roadmap: A Practical Guide to Diversifying Charity Income

Relying on a single source of income is a high-risk strategy in today’s climate. Building long-term charity financial resilience requires a deliberate and strategic approach to income diversification. This means creating a healthy mix of revenue streams that can cushion your organisation from shocks in any one area. To begin, you can assess your organisation’s current state using a simple ‘Financial Sustainability Maturity Model’: Are you ‘Reactive’ (dependent on one or two grants), ‘Developing’ (experimenting with new income), or ‘Resilient’ (managing a balanced portfolio of revenue streams)?

The goal is to move along this spectrum by exploring new models of non-profit income generation.

Earned Income: Exploring Social Enterprise and Trading

Earned income is revenue generated from selling goods or services, and it represents a powerful path toward self-sufficiency. This can range from renting out unused office space to launching a full-fledged social enterprise—a business that trades to achieve a social purpose, with profits reinvested back into the mission.

For example, a youth services charity could launch a coffee shop that provides employment training and skills to young people, with all profits funding the charity’s core youth programs. While this model offers sustainable, unrestricted funding, it’s crucial to consider the legal and ethical implications. Significant trading activities may need to be housed in a separate trading subsidiary to protect the charity’s assets and charitable status.

Strategic Partnerships: Building Value with Corporates and Communities

Modern partnerships go far beyond a simple logo on a banner. Strategic corporate and community partnerships are about creating shared value. Instead of just asking for a donation, consider what your charity can offer in return. This could be employee engagement and volunteering opportunities, expert insights into a social issue relevant to the company’s CSR goals, or access to a dedicated community audience.

As one experienced charity leader noted, “The most successful partnerships are built on mutual benefit and a shared vision. When a corporate partner truly understands and invests in your mission, they become an advocate, not just a donor.” Building these strong, long-term relationships creates a more stable and predictable funding source than one-off sponsorship deals.

Digital Transformation: Leveraging Technology for Sustainable Fundraising

Digital technology offers powerful tools for creating steady and predictable revenue. Recurring giving programs are the cornerstone of this approach. By encouraging supporters to sign up for small, regular monthly donations through platforms like Donorbox, you can build a reliable stream of unrestricted income that is less susceptible to fundraising campaign fatigue.

Beyond donations, technology can unlock new efficiencies. Using data analytics to understand donor behaviour allows you to tailor your communications and appeals, increasing their effectiveness. Membership models, managed through platforms like WildApricot, can create a loyal community of supporters who contribute financially in exchange for exclusive content or benefits. This digital transformation is a key component of building a modern, resilient financial model.

A Toolkit for Small Charities: Overcoming Unique Financial Hurdles

Small charities are the lifeblood of the UK’s non-profit sector, yet they often face the most acute financial challenges. The Charity Finance Group’s survey of its small and micro members paints a clear picture of rising demands, escalating costs, and intense stress levels.3 With limited staff and resources, the need for efficient, high-impact strategies is paramount. This section is dedicated to providing tailored, low-resource solutions to help small organisations not just survive, but thrive. For more in-depth support, the CFG offers a range of Free Finance Guides for Small Charities.

How to Compete for Grants When You’re Outgunned

The grant application process can feel like an uphill battle for small charities competing against larger organisations with dedicated fundraising teams. The administrative burden is immense. To level the playing field, focus on strategy and efficiency. Instead of starting from scratch every time, create a “master proposal” document containing your core mission, impact data, and key project descriptions. This can be quickly adapted for different funders.

Focus on building deep relationships with a smaller number of relevant funders rather than scattering applications widely. Emphasise your unique value: your deep community connections, your agility, and your low overheads. To streamline the search process itself, intelligent platforms are emerging to help smaller teams work smarter. Solutions like FundRobin use AI to match organisations with the most relevant grant opportunities, saving hundreds of hours of manual research and allowing you to focus your precious time on crafting the perfect application.

Low-Effort, High-Impact Financial Management Tactics

When you don’t have a dedicated finance manager, simplicity and clarity are key. Focus on a few core financial practices that deliver the most value:

- A Live Cash Flow Forecast: This is your most critical tool. A simple spreadsheet tracking money in and money out over the next 12 months can give you an early warning of potential shortfalls.

- Simple Monthly Reporting: Create a one-page financial dashboard for your trustees that shows income vs. budget, expenditure vs. budget, and your current reserves level. This keeps everyone informed and accountable.

- Leverage Low-Cost Tech: As advised by sources like Charity Digital, there are many affordable cloud accounting tools (like Xero or QuickBooks) that can automate invoicing, expense tracking, and reporting, saving significant administrative time.

These tactics, which can be supported by templates in our downloadable toolkit, ensure that even with limited staff, you can maintain robust financial oversight.

Conclusion

The financial pressures facing UK charities in 2025 are severe. The “Perfect Storm” of inflation, funding cuts, and rising demand is testing the resilience of the entire sector. Yet, these challenges are not insurmountable. By moving from a reactive stance to a proactive, strategic one, your organisation can navigate this difficult period and emerge stronger.

The journey from crisis to resilience is built on three pillars: strengthening your internal governance with a robust reserves policy, strategically diversifying your income beyond traditional sources, and equipping your team with the right tools and tactics for your size. This guide provides the foundational toolkit for that journey. The path forward requires courage, creativity, and a commitment to sustainable financial management.

Don’t just survive the squeeze, build a more resilient future for your charity. Read our guide on how to build your financial foundations to enable your organisation for success.

This article provides informational guidance and is not a substitute for professional financial or legal advice. Charity trustees and managers should consult with qualified accountants or financial advisors for decisions specific to their organization’s circumstances.

Sources & Further Reading

- The Charity Commission for England and Wales. (N.D.). Charity reserves: building resilience (CC19). GOV.UK. Retrieved from https://www.gov.uk/government/publications/charities-and-reserves-cc19/charities-and-reserves

- NCVO. (2024). The Road Ahead 2024: Opportunities and challenges for the voluntary sector. Retrieved from https://www.ncvo.org.uk/news-and-insights/news-index/road-ahead-2024/the-road-ahead-2024-opportunities-challenges-voluntary-sector/

- Charity Finance Group. (N.D.). CFG survey: “Costs have gone up…while we’re expected to deliver more”. Retrieved from https://cfg.org.uk/cfg_small_charity_survey_costs_have_gone_up_while_we_are_expected_to_deliver_more

- The Charity Commission for England and Wales. (N.D.). Managing financial difficulties and insolvency in charities (CC12). GOV.UK. Retrieved from https://www.gov.uk/government/publications/managing-financial-difficulties-insolvency-in-charities-cc12

Comments

One response to “From Crisis to Resilience: The UK Charity’s Guide to Navigating 2025’s Financial Pressures”

[…] The sector’s donor retention problem is a perpetually leaky bucket. Losing more than half of your donors every year is an unsustainable model, forcing a constant, expensive scramble for new acquisitions. This epidemic is fuelled by a combination of donor fatigue, widespread economic pressure on household budgets, and a fundamental mismatch in communication. As the latest Giving USA 2025 report highlights, the giving landscape is evolving. Nonprofits that continue to rely on generic, one-size-fits-all appeals are finding them increasingly ineffective against the noise, exacerbating the financial pressures of 2025. […]